Last Update: 4 August 2025

The SSC CGL salary ranges from ₹25,500 to ₹1,51,100 per month, depending on the post, pay level, and city of posting, offering a lucrative package with allowances like DA, HRA, and TA.

Disclaimer: The salary details provided are based on the 7th Pay Commission and information available as of August 2025. Actual salaries may vary due to revisions in DA, HRA, or government policies. Always refer to the official SSC notification for the latest updates.

Picture this: you’re sipping chai, scrolling through government job notifications, and suddenly, the SSC CGL salary catches your eye. It’s not just a number—it’s a ticket to financial stability, job security, and a sprinkle of prestige that makes your relatives nod in approval at family gatherings. The Staff Selection Commission’s Combined Graduate Level (SSC CGL) exam is a golden gateway to Group B and C posts in India’s central government, and the salary? Oh, it’s as tempting as a plate of hot jalebis!

In this article, we’re diving deep into the SSC CGL salary structure, breaking down the pay scales, allowances, deductions, and career growth with a conversational twist. Whether you’re an aspirant dreaming of cracking the exam or just curious about the paycheck, we’ve got you covered with witty insights, expert-backed facts, and a user-first approach. Let’s unravel the numbers and perks that make SSC CGL one of India’s most sought-after exams!

Stats Table: SSC CGL Salary Overview (2025)

|

Aspect |

Details |

|---|---|

|

Salary Range |

₹25,500 – ₹1,51,100 per month (varies by post and city) |

|

Pay Levels |

Level 4 to Level 8 |

|

Key Allowances |

Dearness Allowance (DA), House Rent Allowance (HRA), Travel Allowance (TA) |

|

Deductions |

NPS, CGHS, CGEGIS, Income Tax |

|

Highest-Paying Post |

Assistant Audit Officer (AAO): ₹56,100 – ₹1,77,500 |

|

Lowest-Paying Post |

Tax Assistant: ₹25,500 – ₹81,100 |

|

Exam Date (Tier 1) |

August 13–30, 2025 |

What Makes SSC CGL Salary So Attractive?

Let’s be real—government jobs in India are like the holy grail for job seekers. The SSC CGL salary isn’t just about the basic pay; it’s a full-on package deal with allowances, job security, and a pension that screams “retire in style.” But what exactly goes into this paycheck? Let’s break it down like a Bollywood dance sequence—step by step, with flair!

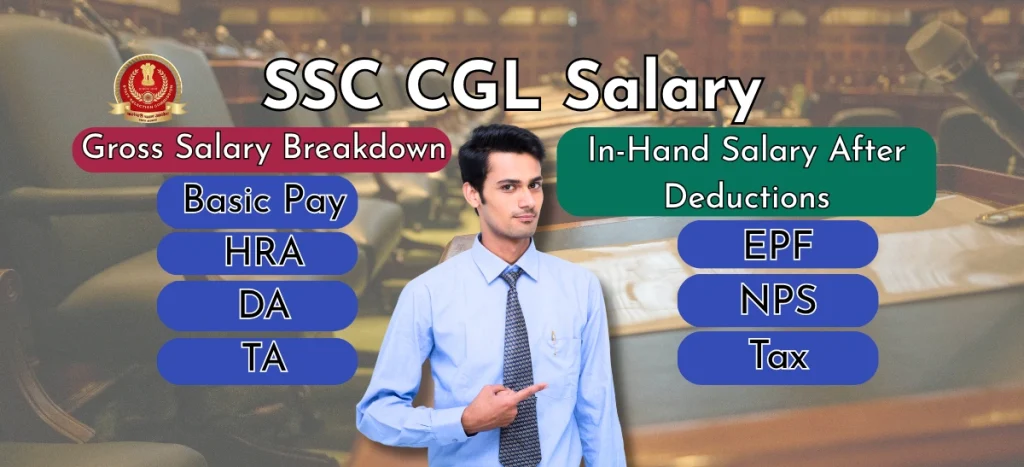

The SSC CGL salary structure is governed by the 7th Pay Commission, introduced to streamline government employee pay and make it inflation-proof. The salary includes:

-

Basic Pay: The fixed amount based on your post’s pay level.

-

Allowances: Think Dearness Allowance (DA), House Rent Allowance (HRA), and Travel Allowance (TA).

-

Deductions: Contributions to the National Pension System (NPS), taxes, and other schemes.

The in-hand SSC CGL salary per month typically ranges from ₹30,000 to ₹70,000, depending on the post and city of posting. Cities are classified as X (metros like Delhi), Y (smaller cities), and Z (rural areas), with X offering the highest allowances.

Expert Insight: “The SSC CGL salary is designed to balance urban and rural postings,” says Priya Sharma, a career counselor with 10 years of experience guiding SSC aspirants. “The HRA in X cities can be a game-changer, especially for young professionals starting their careers.”

Table: City-Wise HRA Rates

|

City Category |

HRA (% of Basic Pay) |

|---|---|

|

X (e.g., Delhi, Mumbai) |

24% |

|

Y (e.g., Lucknow, Jaipur) |

16% |

|

Z (e.g., Rural areas) |

8% |

Post-Wise SSC CGL Salary: Who Earns What?

The SSC CGL salary post-wise varies depending on the pay level and responsibilities. With 14,582 vacancies announced for 2025, there’s a post for every ambition, from desk jobs to fieldwork. Here’s a detailed look at some key posts:

1. Assistant Audit Officer (AAO)

-

Pay Level: 8 (₹47,600 – ₹1,51,100)

-

Basic Pay: ₹47,600

-

In-Hand Salary: ₹58,956 – ₹69,396 (approx.)

-

Role: Conducting financial and performance audits, often with travel.

-

Why It’s Hot: The AAO SSC CGL salary is the highest, making it the crown jewel of SSC posts.

2. Assistant Section Officer (ASO)

-

Pay Level: 7 (₹44,900 – ₹1,42,400)

-

Basic Pay: ₹44,900

-

In-Hand Salary: ₹55,000 – ₹65,000 (approx.)

-

Role: Clerical and administrative tasks in ministries like External Affairs or Railways.

Fun Fact: ASO in the Ministry of External Affairs might land you foreign postings—hello, diplomatic life!

3. Income Tax Inspector

-

Pay Level: 7 (₹44,900 – ₹1,42,400)

-

Basic Pay: ₹44,900

-

In-Hand Salary: ₹58,956 – ₹69,396 (approx.)

-

Role: Assessing taxes, investigating tax fraud, and fieldwork.

-

Why It’s Cool: The SSC CGL salary of Income Tax Officer comes with authority and a badge of prestige.

4. Divisional Accountant

-

Pay Level: 6 (₹35,400 – ₹1,12,400)

-

Basic Pay: ₹35,400

-

In-Hand Salary: ₹45,000 – ₹55,000 (approx.)

-

Role: Managing accounts in government departments.

-

Perk: The divisional accountant SSC CGL salary is decent, with less fieldwork than inspectors.

5. Tax Assistant

-

Pay Level: 4 (₹25,500 – ₹81,100)

-

Basic Pay: ₹25,500

-

In-Hand Salary: ₹30,587 – ₹40,000 (approx.)

-

Role: Clerical tasks in tax departments.

-

Why It’s Entry-Level: The tax assistant SSC CGL salary is the lowest but offers a stable start.

6. Auditor

-

Pay Level: 5 (₹29,200 – ₹92,300)

-

Basic Pay: ₹29,200

-

In-Hand Salary: ₹35,000 – ₹45,000 (approx.)

-

Role: Auditing government accounts.

-

Why It’s Steady: The auditor SSC CGL salary is perfect for those who love numbers and a 9-to-5 desk job.

Table: Post-Wise SSC CGL Salary 2025

|

Post |

Pay Level |

Basic Pay |

In-Hand Salary (Approx.) |

|---|---|---|---|

|

Assistant Audit Officer |

8 | ₹47,600 | ₹58,956 – ₹69,396 |

|

Assistant Section Officer |

7 | ₹44,900 | ₹55,000 – ₹65,000 |

|

Income Tax Inspector |

7 | ₹44,900 | ₹58,956 – ₹69,396 |

|

Divisional Accountant |

6 | ₹35,400 | ₹45,000 – ₹55,000 |

|

Auditor |

5 | ₹29,200 | ₹35,000 – ₹45,000 |

|

Tax Assistant |

4 | ₹25,500 | ₹30,587 – ₹40,000 |

Allowances: The Cherry on Top

The SSC CGL salary isn’t just about the basic pay—it’s the allowances that make it sparkle. Here’s what you get:

-

Dearness Allowance (DA): Currently at 55% of basic pay (as of January 2025), DA adjusts every six months to combat inflation.

-

House Rent Allowance (HRA): Varies by city—24% for X cities, 16% for Y, and 8% for Z.

-

Travel Allowance (TA): Covers commuting expenses, ranging from ₹1,800 to ₹3,600 based on pay level and city.

-

Medical Allowance: Free treatment in government hospitals for you and your dependents.

-

Pension: Covered under the National Pension System (NPS) for a secure retirement.

Expert Insight: “The DA hike is a lifesaver,” says Anil Kumar, a retired SSC officer. “It ensures your SSC CGL salary per month keeps pace with rising costs, unlike many private-sector jobs.”

Table: Allowance Breakdown (Example for Pay Level 7, X City)

|

Component |

Amount (₹) |

|---|---|

|

Basic Pay |

44,900 |

|

DA (55%) |

24,695 |

|

HRA (24%) |

10,776 |

|

TA |

3,600 |

|

Gross Salary |

83,971 |

|

Deductions (NPS, Tax) |

~10,000 |

|

In-Hand Salary |

~73,971 |

Deductions: The Not-So-Fun Part

Every SSC CGL salary slip has deductions, but don’t worry—they’re for your future! Common deductions include:

-

National Pension System (NPS): 10% of basic pay + DA.

-

Central Government Health Scheme (CGHS): For medical benefits.

-

Central Government Employees Group Insurance Scheme (CGEGIS): For insurance.

-

Income Tax: Based on your slab.

After deductions, the SSC CGL salary in hand is what you take home. For example, an ASO in Delhi might see deductions of ₹8,000–₹12,000, leaving a comfy in-hand salary.

Career Growth and Salary After 5 & 10 Years

The SSC CGL salary after 5 years and SSC CGL salary after 10 years grows through annual increments (3% of basic pay) and promotions. Here’s a peek:

-

After 5 Years: An AAO’s salary could rise to ₹65,000–₹70,000 with increments and DA hikes.

-

After 10 Years: With promotions, an AAO could earn ₹80,000+ or move to higher posts like Senior Audit Officer.

-

Promotions: Depend on seniority, departmental exams, or performance. For example, an Income Tax Inspector can become an Assistant Commissioner in 8–10 years.

Table: Salary Growth Example (AAO)

|

Years of Service |

Basic Pay (₹) |

In-Hand Salary (Approx., ₹) |

|---|---|---|

|

Starting |

47,600 | 58,956 – 69,396 |

|

After 5 Years |

~56,000 | 65,000 – 70,000 |

|

After 10 Years |

~70,000 | 80,000+ |

Expert Insight: “Promotions in SSC CGL are structured but competitive,” says Rakesh Gupta, a former Income Tax Inspector. “Clearing departmental exams can fast-track your career and boost your SSC CGL salary significantly.”

The 8th Pay Commission: What’s the Buzz?

Rumors about the SSC CGL salary after 8th Pay Commission are swirling, but as of August 2025, it’s not implemented. The 7th Pay Commission still rules, with DA hikes keeping salaries inflation-proof. If the 8th Pay Commission rolls out, expect a 20–25% jump in basic pay, but don’t hold your breath—it’s still in talks!

Why Choose SSC CGL? The Perks Beyond Salary

The SSC CGL salary is just the start. Here’s why candidates go gaga over these jobs:

-

Job Security: Government jobs are as stable as your grandma’s recipe for aloo paratha.

-

Work-Life Balance: Regular hours, paid leaves, and LTC (Leave Travel Concession).

-

Prestige: Being an Income Tax Inspector or ASO comes with societal respect.

-

Pension: NPS ensures you retire with a safety net.

Table: Perks of SSC CGL Jobs

|

Perk |

Description |

|---|---|

|

Job Security |

Lifetime employment with minimal risk of layoffs |

|

Pension |

NPS for retirement benefits |

|

Medical Benefits |

Free treatment for employees and dependents |

|

Leave Benefits |

Earned leave, casual leave, and LTC |

Conclusion: Is the SSC CGL Salary Worth the Hustle?

The SSC CGL salary is more than just a paycheck—it’s a lifestyle upgrade. With in-hand salaries ranging from ₹30,000 to ₹70,000, generous allowances, and a secure career path, it’s no wonder lakhs of aspirants dream of cracking this exam. Whether you’re eyeing the top-tier AAO SSC CGL salary or the steady tax assistant SSC CGL salary, the rewards are worth the grind. So, grab your study notes, channel your inner nerd, and aim for that government job glory!

FAQs

1. SSC CGL ki salary kitni hoti hai?

The SSC CGL salary per month ranges from ₹30,587 to ₹69,396, depending on the post, pay level, and city of posting. For example, an Assistant Audit Officer earns the highest, while a Tax Assistant earns the least.

2. What is the starting salary of SSC CGL?

The starting SSC CGL salary begins at ₹25,500 (basic pay for Pay Level 4) and goes up to ₹47,600 (Pay Level 8), with in-hand salaries of ₹30,000–₹70,000 after allowances.

3. Which post in SSC CGL has the highest salary?

The Assistant Audit Officer (AAO) has the highest SSC CGL salary, with a basic pay of ₹47,600 and an in-hand salary of ₹58,956–₹69,396.

4. Is SSC CGL easy to crack?

Cracking SSC CGL is challenging due to high competition (over 20 lakh candidates in 2025) and a rigorous four-tier exam process. However, with consistent preparation (6–12 months), strong basics in Quant, Reasoning, English, and General Awareness, it’s achievable.

5. Can I crack CGL in 15 days?

Cracking SSC CGL in 15 days is nearly impossible for beginners due to the vast syllabus and competition. However, if you’re already well-prepared, 15 days of intense revision and mock tests can sharpen your skills.

Thank You!

Loved this deep dive into the SSC CGL salary? Check out our previous blogs —

40 LPA In-Hand Salary: Your Complete Guide to ₹2.7L Monthly Take-Home

Gratuity Calculator 2025: Your Complete Retirement Benefits Guide

PIFRA Salary Slip: Complete 5-Step Guide for Government Employees

Check out this In Hand Salary Calculator by Dimensions Path to calculate your In Hand.