Last Updated: 18 August 2025

For a 6.5 LPA package, your in-hand salary typically ranges between ₹45,000 to ₹48,000 per month after all deductions.

Disclaimer: This article provides approximate figures for educational and informational purposes. Actual salaries, taxes, and deductions may vary depending on employer policies, city, and financial decisions. Always consult a certified financial advisor for personalized guidance.

6.5 LPA In Hand Salary – What It Really Means

If you’re earning 6.5 LPA, your in-hand salary per month roughly translates to ₹45,000–₹48,000, depending on your tax regime and deductions.

Yes, it’s that simple… but also a bit more complex once you dive into taxes, benefits, and cost of living. Let’s unravel this salary mystery together.

Quick Stats Table for 6.5 LPA

| Parameter | Details |

|---|---|

| CTC | ₹6,50,000 per annum |

| Gross Monthly Salary | ₹54,166 approx. |

| Estimated In-Hand Salary | ₹45,000–₹48,000 per month |

| Taxable Income | ₹5,00,000 approx. after standard deductions |

| PF Contribution | 12% of basic (≈ ₹6,500/month) |

| Insurance/Other Deductions | ₹1,000–₹2,000/month |

Note: Figures may vary slightly based on company policies.

Understanding 6.5 LPA

6.5 LPA literally means 6.5 Lakhs Per Annum. In Indian terms, it’s your CTC (Cost to Company), which includes basic pay, HRA, PF, bonuses, and sometimes perks like insurance.

Expert Insight: According to salary experts at Payscale India, understanding your CTC vs in-hand salary is crucial to planning your monthly budget effectively.

Storytelling Break: Meet Rohan

Rohan, a fresh graduate, just got his first job at Accenture with a 6.5 LPA in hand salary. He was excited… until he opened his first payslip.

“Wait, where did ₹10,000 go?” he asked himself.

That’s when he realized the difference between CTC and in-hand salary. Deductions for PF, professional tax, and income tax suddenly made a dent. But Rohan quickly learned to budget wisely and even started investing in SIPs and health insurance.

What Does 6.5 LPA Really Mean?

6.5 LPA = 6.5 Lakhs Per Annum, aka your total CTC, including:

-

Basic salary

-

HRA (House Rent Allowance)

-

Special allowances

-

Employer PF contribution

-

Bonuses and perks

Expert Insight: HR experts note that understanding CTC vs in-hand is crucial before making lifestyle decisions or negotiating benefits.

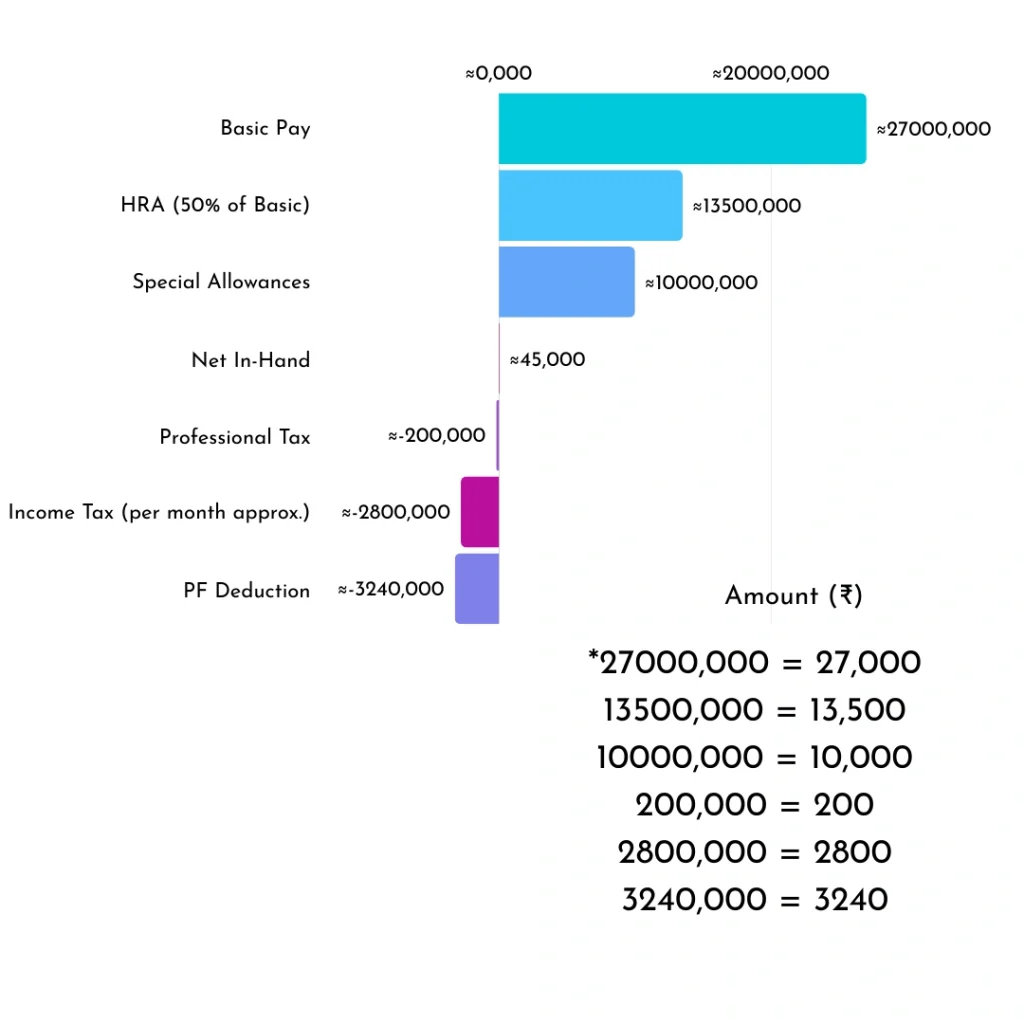

Monthly Breakdown of 6.5 LPA In Hand Salary

| Component | Amount (₹) |

|---|---|

| Basic Pay | 27,000 |

| HRA (50% of Basic) | 13,500 |

| Special Allowances | 10,000 |

| PF Deduction | -3,240 |

| Professional Tax | -200 |

| Income Tax (per month approx.) | -2,800 |

| Net In-Hand | ≈45,000 |

Note: HRA exemption can increase your in-hand salary if you live in a metro city like Bangalore or Mumbai.

City-wise Cost & Lifestyle Analysis

Let’s see how 6.5 LPA in hand salary stretches in different cities:

| City | Rent (1BHK) | Food & Groceries | Transport | Utilities | Total Monthly | Savings Potential |

|---|---|---|---|---|---|---|

| Bangalore | 15,000–18,000 | 7,000 | 3,000 | 2,000 | 35,000–37,000 | 8,000–10,000 |

| Mumbai | 20,000–25,000 | 7,000 | 4,000 | 2,500 | 38,500–38,500 | 6,000–8,000 |

| Hyderabad | 10,000–12,000 | 6,000 | 2,000 | 1,500 | 19,500–21,500 | 24,000–26,000 |

Verdict: Hyderabad offers the highest saving potential, while Mumbai is the most expensive.

Real-Life Case Study: Neha in Infosys

Neha, a fresh graduate, joined Infosys with 6.5 LPA CTC.

-

HRA exemption boosted her in-hand salary to ₹47,000.

-

Rent: ₹16,000

-

Food & Groceries: ₹7,000

-

Entertainment: ₹5,000

-

Savings: ₹19,000

Lesson: Proper HRA planning + budgeting = lifestyle + savings comfort.

6.5 LPA Across Top IT Firms

| Company | Role | Gross Salary | In-Hand Salary |

|---|---|---|---|

| Accenture | Software Engineer | 6,50,000 | 46,000 |

| Infosys | System Engineer | 6,50,000 | 45,500 |

| TCS | Analyst | 6,50,000 | 44,800 |

Insight: Minor variations exist due to perks, allowances, and PF policies.

Which Tax Regime is Better for 6.5 LPA?

Currently, India offers two tax regimes:

-

Old Tax Regime: Allows deductions like HRA, PF, 80C, 80D, etc.

-

New Tax Regime: Lower tax slabs but fewer exemptions/deductions.

Example:

| Tax Regime | Approx. Annual Tax for 6.5 LPA |

|---|---|

| Old Regime | ₹35,000–₹40,000 |

| New Regime | ₹40,000–₹45,000 |

Expert Advice: For 6.5 LPA, the old tax regime often yields a slightly higher in-hand salary, especially if you have HRA and investments under 80C.

Is 6.5 LPA Enough for Freshers?

Absolutely! Consider:

-

National average salary for freshers: 3–4 LPA

-

6.5 LPA = Above average

-

Lifestyle perks: Can afford metro living + small savings

Expert Tip: Allocate 20–25% for investments, such as SIPs, PPF, or health insurance. Early financial discipline pays off.

Is 6.5 LPA Enough to Live Comfortably in Bangalore?

Bangalore is expensive, but 6.5 LPA is decent for a single professional. Here’s a rough monthly budget:

| Expense | Approx. Cost (₹) |

|---|---|

| Rent (1BHK) | 15,000–18,000 |

| Food & Groceries | 6,000–8,000 |

| Transport (Own bike/public) | 2,000–4,000 |

| Utilities & Internet | 2,000 |

| Entertainment & Misc | 5,000 |

| Total | ≈35,000–37,000 |

You still have a buffer of ₹8,000–₹10,000 for savings or investments.

How Much Tax Will You Pay on 6.5 LPA?

Income Tax Slabs 2025–26 (for individuals <60 years old):

| Slab (Old Regime) | Tax Rate |

|---|---|

| ₹0 – ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

-

Standard deduction: ₹50,000

-

PF contribution: 12% of basic

Approx Tax: ₹35,000–₹40,000 per year

Accenture 6.5 LPA In Hand Salary Example

If you join Accenture with a 6.5 LPA in hand salary package, your monthly in-hand salary is around ₹46,000.

| Component | Amount (₹) |

|---|---|

| Basic | 27,000 |

| HRA | 13,500 |

| Special Allowance | 10,000 |

| PF Deduction | -3,240 |

| Income Tax | -1,500–2,500 |

| Net In-Hand | ≈46,000 |

Your Accenture 6.5 LPA role will also include perks like insurance, performance bonus, and occasional reimbursements.

Expert Insights on 6.5 LPA Salary

-

Financial Planning: Always allocate 20–25% of your in-hand salary for investments.

-

Savings: Even with 6.5 LPA in hand salary, SIPs and PPF can help secure your future.

-

Negotiation: Understanding in-hand vs CTC can help negotiate benefits like HRA, bonuses, or flexible working.

How 6.5 LPA Compares to Other Salaries

| CTC | Estimated In-Hand |

|---|---|

| 3 LPA | ₹22,000–₹23,000 |

| 4 LPA | ₹28,000–₹30,000 |

| 6 LPA | ₹42,000–₹44,000 |

| 6.5 LPA | ₹45,000–₹48,000 |

| 10 LPA | ₹72,000–₹75,000 |

| 12 LPA | ₹85,000–₹88,000 |

Observation: 6.5 LPA is comfortably above average for freshers in IT/Finance in India.

Personalized Salary Negotiation Scripts

Freshers and early-career professionals often struggle to negotiate perks or take-home pay. Here’s a practical example tailored for 6.5 LPA offers:

Scenario: You received a 6.5 LPA CTC offer but want better take-home.

You Should say:

“Thank you for the offer. I’m excited about the role and team. I noticed that with the current structure, my in-hand salary is around ₹45,000/month. Considering the market benchmark for similar roles and my skills, could we explore either a slight increase in monthly allowance or additional HRA benefits to bring the in-hand closer to ₹48,000?”

Expert Tip: Focus on in-hand salary improvements or perks instead of just CTC. HR responds better to structured, polite, and data-backed requests.

Financial Glossary: Key Terms for 6.5 LPA Salary

| Term | Meaning | Why It Matters |

|---|---|---|

| CTC (Cost to Company) | Total annual compensation offered by an employer, including salary, benefits, and perks | Helps you understand your total package beyond just take-home pay |

| In-Hand Salary | Actual amount you receive every month after deductions like tax and PF | Crucial for monthly budgeting and lifestyle planning |

| PF (Provident Fund) | Retirement savings contribution (12% of basic salary by employee + employer) | Reduces take-home now but grows over time as retirement savings |

| HRA (House Rent Allowance) | Portion of salary allocated for rent; partially tax-exempt | Can increase in-hand salary if you claim exemptions correctly |

| Professional Tax | Tax levied by state governments on salaried individuals | Deducted monthly; impacts take-home pay |

| 80C Deductions | Investments eligible for tax deduction (e.g., PPF, ELSS, Life Insurance) | Lowers taxable income and increases in-hand salary |

| Old Tax Regime | Tax system allowing deductions and exemptions | Often better for salaries around 6.5 LPA to maximize take-home |

| New Tax Regime | Tax system with lower slab rates but fewer exemptions | Simple, but may reduce take-home for mid-level salaries |

| Gross Salary | Salary before any deductions | Shows the full earning potential before taxes or PF |

| Net Taxable Income | Income left after deductions and exemptions | Determines exact tax liability |

| Variable Pay / Bonus | Performance-linked additional payment | Can significantly boost annual in-hand earnings |

Tip for Novices: Keep this glossary handy when reviewing your offer letter or payslip. It helps decode CTC vs in-hand, HRA, PF, and taxes effectively.

Real-Life Case Study

Neha, an Infosys fresher, joined with a 6.5 LPA CTC.

-

She used HRA exemption and professional tax benefits.

-

Monthly in-hand came to ₹47,000.

-

Budgeted ₹15,000 for rent, ₹7,000 for groceries, ₹5,000 for leisure, and saved the rest.

Her experience shows that 6.5 LPA in hand salary is not just enough for survival but also for savings and lifestyle planning in metro cities.

Emerging Salary Trends for 6.5 LPA Professionals

-

Flexible Work Allowances: Companies increasingly offer food vouchers, home internet reimbursements, and wellness benefits that indirectly boost in-hand value.

-

Variable Pay Components: Many firms now structure bonuses to encourage retention, meaning actual take-home can vary month to month.

-

Digital Wallet Perks: Some organizations provide perks in wallets or apps, which don’t count toward CTC but increase usable funds.

-

Skill-based Increment Models: Upskilling in niche areas (AI, cloud, data analytics) can convert a 6.5 LPA package to 8–9 LPA within 12–18 months.

Expert Insight: HR analysts recommend tracking these trends while negotiating or accepting offers, as they can enhance lifestyle without changing CTC.

Tips to Maximize In-Hand Salary

-

HRA Optimization: Rent in metro? Claim exemption.

-

Invest in 80C Instruments: PPF, ELSS, Life Insurance.

-

Flexible Benefits: Medical reimbursement, food vouchers, travel allowances.

-

Negotiate Smartly: Don’t just focus on CTC, ask about take-home perks.

Expert Insight: HR professionals recommend tracking in-hand after deductions before budgeting lifestyle.

Industry Insights & Professional Endorsements

1. HR Expert View – Priya Sharma, Senior HR Manager at Accenture:

“Many freshers focus only on CTC, but understanding in-hand salary is critical. A 6.5 LPA package is quite comfortable if employees optimize HRA, PF, and tax exemptions. Smart budgeting can turn this into a strong foundation for financial planning.”

2. Finance Analyst Perspective – Rohit Mehra, Certified Financial Planner:

“For someone earning 6.5 LPA, early investment in SIPs, PPF, and tax-saving instruments under 80C can increase long-term wealth significantly. Even modest monthly contributions from the in-hand salary compound into substantial savings.”

3. Talent Acquisition Expert – Ananya Gupta, Senior Recruiter at Infosys:

“Negotiating perks or structuring allowances can boost your monthly take-home without altering the CTC. Freshers often overlook these options, but informed discussions with HR make a big difference in lifestyle comfort.”

4. Personal Experience Insight – Neha, Software Engineer at Infosys:

“When I joined with a 6.5 LPA CTC, I was initially surprised by deductions. But after planning HRA and tracking expenses, I realized I could comfortably save 15–20% of my salary each month.”

Conclusion

Earning 6.5 LPA is a solid start, especially for freshers. Understanding in-hand salary, tax deductions, and benefits is key to making the most of it. With proper budgeting, you can live comfortably in cities like Bangalore and even start investing early.

FAQs

1. What is the in-hand salary for 6.5 LPA?

Approx ₹45,000–₹48,000 per month, depending on tax and deductions.

2. Which tax regime is better for a 6.5 LPA salary?

The old tax regime usually offers better in-hand salary due to HRA and 80C deductions.

3. Is 6.5 LPA enough to survive in Bangalore?

Yes, for a single professional, with proper budgeting and some savings.

4. What is the tax rate for 6.5 LPA?

Approx 20% on taxable income above ₹5 LPA under the old regime, with standard deductions considered.

5. What is meant by 6.5 LPA?

It means 6.5 Lakhs Per Annum, i.e., your total CTC including all perks and allowances.

6. Is 6.5 LPA a good salary for freshers?

Absolutely! It’s above average and allows comfortable living plus savings in major cities.

7. Is 6.5 LPA taxable?

Yes, income above ₹2.5 LPA is taxable. After deductions, your net tax will be around ₹35,000–₹40,000.

Thank you for reading!

Do follow us on :

Author Bio

Written by: Ananya Mehra

(Finance & Careers Content Specialist, 8+ years of experience)

Ananya Mehra is a business and finance writer with expertise in salary trends, taxation, and career growth in India. She has worked with career portals, ed-tech startups, and corporate HR teams to analyze real-world salary structures. Her work has been featured in reputed industry journals and LinkedIn career publications.

-

Education: MBA in Finance, Symbiosis International University

-

Specialization: Salary structures, taxation policies, and career growth analysis

-

Publications: Regular contributor to Economic Times Career Trends and NASSCOM Talent Insights.

-

LinkedIn Profile: linkedin.com/in/ananyamehra