Last Update: 4 August 2025

A 40 LPA package typically translates to ₹2.7-2.9 lakhs in-hand salary per month after all deductions including taxes, PF, and other statutory contributions.

Disclaimer: The salary calculations, tax computations, and financial advice provided in this article are for general informational purposes only and are based on standard assumptions as of 2024-25. Actual in-hand salary may vary based on company policies, salary structure, individual tax situations, state-specific taxes, and current tax laws. Please consult with a qualified tax advisor or financial planner for personalized advice. Tax laws and rates are subject to change, and individual circumstances may significantly impact actual take-home salary.

So, you’ve landed that dream job offer with a 40 LPA package, and now you’re wondering what actually lands in your bank account every month? Well, buckle up because we’re about to dive deep into the world of salary calculations, tax deductions, and everything that comes between your gross salary and your actual take-home pay!

Let’s be honest – when someone mentions 40 LPA salary, your first thought probably isn’t about tax calculations or provident fund deductions. You’re likely already planning that vacation to Bali or calculating how many years it’ll take to buy that dream car. But before you start splurging, let’s get real about what 40 LPA in hand salary actually means for your monthly budget.

Quick Stats: 40 LPA Salary Breakdown

| Component | Amount (Annual) | Amount (Monthly) |

|---|---|---|

| Gross Salary (CTC) | ₹40,00,000 | ₹3,33,333 |

| Income Tax | ₹8,50,000 | ₹70,833 |

| Employee PF (12%) | ₹2,16,000 | ₹18,000 |

| Professional Tax | ₹2,400 | ₹200 |

| Other Deductions | ₹60,000 | ₹5,000 |

| In-Hand Salary | ₹32,71,600 | ₹2,72,633 |

Note: Calculations based on standard deductions and new tax regime for FY 2024-25

Understanding What 40 LPA Really Means

When we talk about 40 LPA means, we’re referring to your Cost to Company (CTC) – the total amount your employer spends on you annually. But here’s the catch: CTC is like that Instagram photo with perfect lighting and filters. Your 40 LPA in hand salary is more like the real you at 6 AM without coffee – still good, but definitely different!

Breaking Down the CTC Components

| CTC Component | Typical Percentage | Amount (₹) |

|---|---|---|

| Basic Salary | 40-50% | ₹16-20 lakhs |

| House Rent Allowance | 20-25% | ₹8-10 lakhs |

| Special Allowance | 15-20% | ₹6-8 lakhs |

| Employer PF Contribution | 12% of Basic | ₹1.92-2.4 lakhs |

| Gratuity | 4.81% of Basic | ₹77k-96k |

| Medical Insurance | Fixed | ₹25k-50k |

| Other Benefits | Variable | ₹1-3 lakhs |

The in hand salary for 40 LPA depends heavily on how your company structures these components. A smart salary structure can significantly impact your 40 LPA ctc in hand salary.

Tax Calculations: Where Your Money Actually Goes

Let’s get to the meat of the matter – taxes! With a 40 LPA package, you’re comfortably sitting in the highest tax bracket, which means Uncle Sam (or should we say, Uncle Modi?) wants his fair share.

New Tax Regime vs Old Tax Regime

| Tax Regime | Tax Liability | Effective Tax Rate | 40 LPA In Hand Salary |

|---|---|---|---|

| New Regime | ₹8,50,000 | 21.25% | ₹2,72,600/month |

| Old Regime | ₹9,75,000 | 24.38% | ₹2,62,100/month |

Assuming standard deductions and no additional investments

The 40 LPA in hand salary new tax regime is generally more favorable for high earners like yourself, giving you an extra ₹10,000+ monthly compared to the old regime.

Monthly Deduction Breakdown

| Deduction Type | Monthly Amount | Annual Impact |

|---|---|---|

| Income Tax (TDS) | ₹70,833 | ₹8,50,000 |

| Employee PF | ₹18,000 | ₹2,16,000 |

| Employee ESI | ₹0 | ₹0 (Above threshold) |

| Professional Tax | ₹200 | ₹2,400 |

| Total Deductions | ₹89,033 | ₹10,68,400 |

The Reality Check: What ₹2.7 Lakhs Monthly Means

So, your 40 LPA monthly salary after all deductions comes to approximately ₹2.7 lakhs. Sounds impressive, right? But let’s put this into perspective with some real-world scenarios.

Cost of Living Analysis for Major Cities

| City | Rent (3BHK) | Monthly Expenses | Savings Potential |

|---|---|---|---|

| Mumbai | ₹80,000-1,20,000 | ₹1,50,000 | ₹1,22,000 |

| Bangalore | ₹60,000-90,000 | ₹1,30,000 | ₹1,42,000 |

| Delhi/NCR | ₹70,000-1,00,000 | ₹1,40,000 | ₹1,32,000 |

| Pune | ₹50,000-75,000 | ₹1,20,000 | ₹1,52,000 |

| Hyderabad | ₹45,000-70,000 | ₹1,15,000 | ₹1,57,000 |

With a take home for 40 LPA of ₹2.7 lakhs, you’re looking at a comfortable lifestyle in any Indian city, with substantial savings potential.

How to Achieve That 40 LPA Package

Now that we’ve covered what you’ll actually take home, let’s talk about how to get 40 LPA package in india. Spoiler alert: it’s not just about being really good at coding (though that helps).

Top Industries Offering 40+ LPA Packages

| Industry | Average Package Range | Key Skills Required |

|---|---|---|

| Technology | ₹35-60 LPA | Cloud, AI/ML, Full-stack |

| Investment Banking | ₹40-80 LPA | Finance, Analytics, CFA |

| Consulting | ₹35-70 LPA | Strategy, MBA, Problem-solving |

| Product Management | ₹40-65 LPA | Tech+Business, Leadership |

| Data Science | ₹30-55 LPA | Python, ML, Statistics |

Experience Level Requirements

| Experience | Typical Package Range | Success Factors |

|---|---|---|

| 3-5 years | ₹25-45 LPA | Exceptional performance, right company |

| 5-8 years | ₹35-60 LPA | Leadership skills, domain expertise |

| 8-12 years | ₹45-80 LPA | Management experience, strategic thinking |

Smart Financial Planning with 40 LPA

Having a 40 LPA fixed in hand salary of ₹2.7 lakhs monthly is great, but what you do with it determines your financial future. Let’s break down some smart strategies.

Recommended Monthly Budget Allocation

| Category | Percentage | Amount (₹) | Purpose |

|---|---|---|---|

| Savings & Investments | 40% | ₹1,08,000 | SIP, Stocks, Real Estate |

| Living Expenses | 35% | ₹95,000 | Rent, Food, Utilities |

| Lifestyle & Entertainment | 15% | ₹41,000 | Travel, Dining, Shopping |

| Emergency Fund | 10% | ₹27,000 | 6-month expense buffer |

Investment Strategies for High Earners

| Investment Type | Monthly Allocation | Expected Returns | Tax Benefits |

|---|---|---|---|

| Equity Mutual Funds | ₹50,000 | 12-15% | LTCG after 1 year |

| PPF | ₹12,500 | 7-8% | 80C + Tax-free returns |

| Real Estate | ₹30,000 | 8-12% | Various deductions |

| Stocks | ₹15,500 | 10-20% | LTCG benefits |

The Government Job Comparison Dilemma

Here’s a question that keeps many people up at night: which is better, a 40 LPA private job or an 8 LPA government job? It’s like comparing a sports car with a reliable sedan – both have their merits.

Private vs Government Job Comparison

| Factor | 40 LPA Private | 8 LPA Government | Winner |

|---|---|---|---|

| Monthly Take-home | ₹2,70,000 | ₹65,000 | Private |

| Job Security | Moderate | Very High | Government |

| Work-Life Balance | Variable | Generally Better | Government |

| Growth Potential | Unlimited | Structured/Limited | Private |

| Retirement Benefits | Depends on company | Pension + Benefits | Government |

| Social Status | High (Money) | High (Stability) | Tie |

The answer depends on your priorities, risk appetite, and life goals. If you’re young, ambitious, and comfortable with calculated risks, the 40 LPA package route makes sense. If you value stability and a guaranteed pension, government service might be your calling.

Regional Variations in 40 LPA Value

Your 40 LPA in hand salary after tax has different purchasing power across Indian cities. Let’s see how far your money stretches.

Purchasing Power Analysis

| City Tier | Cost Index | Effective Salary Value | Lifestyle Quality |

|---|---|---|---|

| Tier 1 (Mumbai, Delhi) | 100 | ₹2,70,000 | Premium |

| Tier 1.5 (Bangalore, Pune) | 85 | ₹3,17,000 | Premium+ |

| Tier 2 (Hyderabad, Chennai) | 70 | ₹3,85,000 | Luxury |

| Tier 3 (Ahmedabad, Kochi) | 55 | ₹4,90,000 | Ultra-luxury |

Common Misconceptions About 40 LPA Salaries

Let’s bust some myths that people have about earning LPA 40:

Myth vs Reality Table

| Myth | Reality | Impact |

|---|---|---|

| “40 LPA means ₹40L in bank” | Actually ₹32L after deductions | 20% less than expected |

| “All 40 LPA jobs are stressful” | Varies by company culture | Depends on choice |

| “You become rich immediately” | Lifestyle inflation is real | Need financial discipline |

| “No financial worries ever” | High EMIs can still stress you | Budget planning essential |

Tax Optimization Strategies

With great salary comes great tax liability. Here are some legitimate ways to optimize your CTC 40 LPA in hand salary:

Tax-Saving Investments

| Investment Option | Section | Max Benefit | Tax Saving |

|---|---|---|---|

| PPF | 80C | ₹1,50,000 | ₹46,800 |

| ELSS Mutual Funds | 80C | ₹1,50,000 | ₹46,800 |

| Health Insurance | 80D | ₹25,000 | ₹7,800 |

| Home Loan Interest | 24(b) | ₹2,00,000 | ₹62,400 |

| NPS | 80CCD(1B) | ₹50,000 | ₹15,600 |

Future Salary Growth Trajectory

If you’re earning 40 LPA jobs in India today, here’s what your salary progression might look like:

Career Growth Projections

| Years of Experience | Expected Package | Monthly In-hand | Key Milestones |

|---|---|---|---|

| Current (40 LPA) | ₹40,00,000 | ₹2,70,000 | Senior Professional |

| +2 years | ₹55,00,000 | ₹3,50,000 | Team Lead/Manager |

| +5 years | ₹75,00,000 | ₹4,70,000 | Senior Manager |

| +8 years | ₹1,00,00,000+ | ₹6,00,000+ | Director/VP Level |

Industry-Specific Insights

Different industries have varying approaches to LPA 40 package structures:

Sector-wise Package Breakdown

| Industry | Fixed Component | Variable Component | Benefits | Total |

|---|---|---|---|---|

| IT Services | 75% (₹30L) | 15% (₹6L) | 10% (₹4L) | ₹40L |

| Product Companies | 60% (₹24L) | 25% (₹10L) | 15% (₹6L) | ₹40L |

| Banking | 70% (₹28L) | 20% (₹8L) | 10% (₹4L) | ₹40L |

| Consulting | 80% (₹32L) | 10% (₹4L) | 10% (₹4L) | ₹40L |

Red Flags to Watch Out For

Not all 40 LPA salary offers are created equal. Here are some warning signs:

Package Structure Red Flags

| Red Flag | Impact | What to Do |

|---|---|---|

| 70%+ Variable Pay | Uncertain income | Negotiate fixed component |

| Unrealistic Targets | High stress, low realization | Clarify achievement criteria |

| No Medical Insurance | Higher effective cost | Factor in private insurance |

| Excessive Notice Period | Career mobility issues | Negotiate reasonable terms |

Conclusion

Earning a 40 LPA in hand salary per month of approximately ₹2.7 lakhs is undoubtedly a significant achievement that places you in the top tier of Indian earners. However, the key to truly benefiting from this income lies not just in earning it, but in understanding exactly what you’re taking home and making smart financial decisions with it.

Remember, your 40 LPA means different things in different contexts – while it’s ₹40 lakhs to your company, it’s about ₹32 lakhs in your bank account after all deductions. The difference between gross and net is substantial, and planning your finances based on realistic take-home figures is crucial for long-term financial success.

Whether you choose the 40 LPA private job route or opt for the security of government employment ultimately depends on your personal values, risk tolerance, and career aspirations. Both paths have their merits, and the “better” choice varies from person to person.

The most important thing is to maintain perspective – earning 40 LPA is fantastic, but it’s what you do with that money that determines your financial future. Invest wisely, save consistently, and don’t let lifestyle inflation eat away all your hard-earned gains.

Frequently Asked Questions (FAQs)

1. How much in hand salary for 40 LPA?

The in hand salary for 40 LPA is approximately ₹2.7-2.9 lakhs per month after all deductions including income tax, provident fund, and other statutory contributions. This translates to about ₹32-35 lakhs annually.

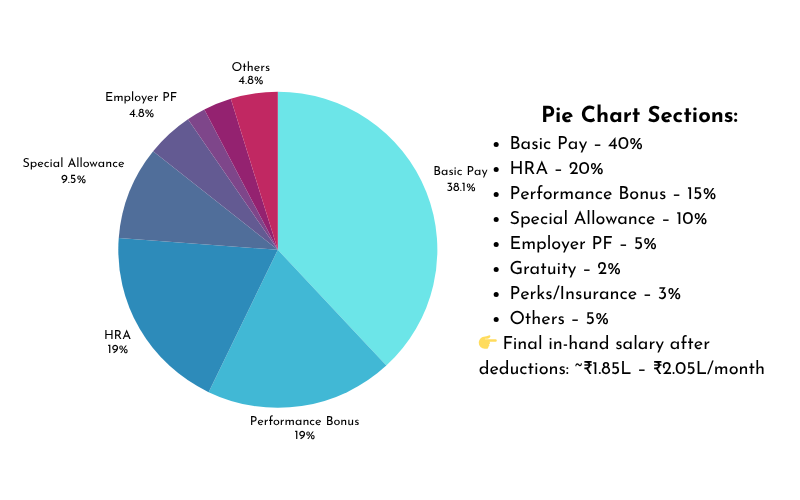

2. What is 40 LPA salary breakdown?

40 LPA salary breakdown typically includes: Basic salary (40-50%), HRA (20-25%), Special allowance (15-20%), and employer contributions to PF, gratuity, and medical insurance making up the remaining amount.

3. How to get 40 LPA package in India?

To achieve a 40 LPA package, focus on high-demand skills like cloud computing, AI/ML, product management, or data science. Target top-tier companies in IT, consulting, or investment banking with 5-8 years of relevant experience.

4. What is 40 LPA monthly salary after tax?

40 LPA monthly salary after all taxes and deductions is approximately ₹2,72,000 under the new tax regime and around ₹2,62,000 under the old tax regime.

5. Which is better: 40 LPA private job or 8 LPA government job?

This depends on your priorities. 40 LPA private job offers higher income and growth potential but less job security. The 8 LPA government job provides stability, pension benefits, and better work-life balance. Choose based on your risk appetite and life goals.

6. What does 40 LPA mean per month?

40 LPA means your annual Cost to Company is ₹40 lakhs, which translates to a gross monthly salary of ₹3.33 lakhs. However, your actual take-home is about ₹2.7 lakhs per month after deductions.

Thank you for reading this comprehensive guide on 40 LPA in-hand salary! We hope this article helped clarify your doubts about salary calculations and financial planning.

For more career and salary insights, check out our previous blogs —

PIFRA Salary Slip: Complete 5-Step Guide for Government Employees

Gratuity Calculator 2025: Your Complete Retirement Benefits Guide

17 LPA In Hand Salary: The Ultimate Guide to Understanding Your Real Take-Home Pay

Check out this In Hand Salary Calculator by Dimensions Path to calculate your In Hand.